When could Venture Debt be the right card to play?

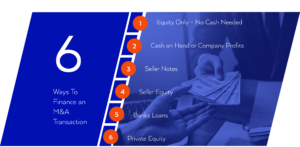

We all know an array of financing options are available, many of which are designed to meet specific needs from an M&A transaction. The picture below resumes the typical 6 options:

(Click on the image on the bottom page to see it in larger mode)

And, of course, choosing the right way to fund a transaction could be critical, knowing that acquisitions can provide companies with an effective way to scale faster, accelerate product development, speed entry into new markets, and strengthen their competitive position.

The article will focus on Venture Debt, a non-classical way to finance a transactional, potentially more adequate for fast-growing, cash-flow-negative companies that traditionally meant raising equity capital. Yet, with growing debt financing options available, companies and their boards should consider how they can incorporate debt into their M&A financing strategies to minimise funding costs and reduce execution risk. This means that Venture Debt should not be the solution, but an ingredient in the right financing formula.

But why should we consider Venture Debt as an option? Due to several benefits, including:

Reduced cost – Debt provides a lower cost of capital than equity, particularly for high-growth companies. By striking the right mix of equity and debt funding, borrowers can significantly lower the overall cost of capital and thus maximize the acquisition’s long-term value creation.

Lower complexity. Using debt financing can help avoid — or at least minimize — complex valuation discussions with equity investors. In doing so, the consequences are reducing transaction complexity and helping free up the management team’s time to focus on evaluating and executing the transaction.

Greater speed – Reduced complexity can also mean greater speed. Being able to move quickly can make the difference between a successful and failed acquisition, particularly in competitive bid situations. That’s where venture debt can be particularly advantageous. It can generally be secured much faster than equity, allowing companies to react quickly to acquisition opportunities.

Deferring equity financing until synergies are realised – A major challenge with raising equity capital to fund acquisition is convincing prospective equity investors of the company’s ability to successfully integrate the new asset and realise key benefits, such as revenue and cost synergies. In some cases, it can be advantageous to use debt to finance some or all of the acquisition and then refinance the debt with equity on more attractive terms once there´s the chance to demonstrate synergies and other benefits of the acquisition.

Enhanced acquisition capacity – Used in conjunction with equity financing, debt can serve to maximise the total available funding, allowing borrowers to pursue larger acquisitions than might be possible using equity alone.

Venture Debt Price

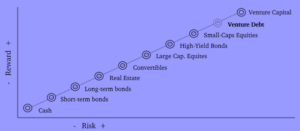

Please look at the Asset Class / Risk Reward Matrix below:

(Click on the image on the bottom page to see it in larger mode)

As a loan, Venture debt is often priced at low double-digits or upper single-digit interest rates. Taking as an example some of the most relevant Tech companies such as Uber (7.5%), Spotify (5-10%) or AirBnB (10%), so seems to be expectable that a low double-digit interest rate doesn’t sound expensive for e.g. a European Series A/ Series B company.

companies such as Uber (7.5%), Spotify (5-10%) or AirBnB (10%), so seems to be expectable that a low double-digit interest rate doesn’t sound expensive for e.g. a European Series A/ Series B company.

The main problem for entrepreneurs is to benchmark Venture debt to commercial bank loans or public financing, which are generally set at mid-low single-digit rates.

Considering the matrix above, the asset class of Venture Debt shall be placed somewhere in between the High-Yield Bond and the Venture Capital and therefore the returns expected from taking such a risk are in the range of 10%-25%. Otherwise, investors would rather move their money onto other less-risky and/or more profitable assets.

Venture debt funds may have very different default rates at different stages (series A, series B…) the more early-stage the Venture debt fund, the more equity-kicker proportion and multiple expectations to offset the higher probability of default within the portfolio. Therefore, setting a fair price on a Venture debt may not be an easy task.

Shorter maturities and collateral may also reduce the deal risk and could release pressure on the equity-kicker. Given the high level of uncertainty on every transaction, there is no easy solution on what the correct pricing should be from a Venture debt perspective.

To sum up, Venture debt is a tailor-made solution for companies and should be considered as an exercise from both parts, companies and the debt providers. A thorough explanation of the company risks and possible ways to mitigate them will enable the Venture debt provider to achieve a lower pricing for the company in order to avoid further dilution.

Conclusion

Venture debt is a lesser-known form of financing compared with venture capital/ other forms of equity financing, however, owing to the rapid growth rate of the number of startups and emerging companies seeking extra and less dilution financing, venture debt has become more popular in recent years.

It is important to note that the availability of debt financing for mid-size M&A transactions can vary depending on the market conditions. However, there has been a growing trend of debt funds providing financing for mid-size M&A transactions in recent years. This is due to a number of factors, including the increasing availability of capital in the debt markets and the growing demand for debt financing from mid-size private equity firms.

That is to say, venture debt providers have more options to choose companies having stronger financial prospects in this fiercely competitive market. Concurrently, the number of active lenders in the venture debt market is also significantly increasing. With the fast development of fintech, conventional venture debts no longer dominate the venture debt industry, the market appears more attractive with innovative financial products and services offered, such as debt crowdfunding. Specialised banks and conventional venture debt providers also offer more flexible terms and higher risk tolerance to compete with the new venture debt organisations.