A global organisation of M&A advisory services.

Established in 2004.

46 offices in 36 countries.

Washington

Represented by

FOCUS Investment Banking

With more than 40 years of market experience we are the leading middle market investment bank providing a range of services with an emphasis on mergers, acquisitions, divestitures and corporate finance.

M&A Worldwide is represented in the USA

by FOCUS Investment Banking.

FIND US:

8065 Leesburg Pike Suite 750

Vienna, VA 22182

+2027859404

Our team

Douglas Rodgers

Rick Thomas

Michael Birmingham

Barry Calogero

Marco Chan

Abe Garver

Stan Gowisnock

James W. Hawkins

Eric Oganesoff

Kelly Kittrell

Evans Love

Jorge A. Maceyras

Bob Maiden

Michael J. McGregor

Richard Pierce

Cyril Schlup

John Slater

April Taylor

Leah White

Paul Waters

Paul Carter

Mike McCraw

John Sinders

William R. Snow

Jim Sowers

Chandler Kohn

Cole Strandberg

Anders Moeller

Bob Bicksler

Chairman

Douglas Rodgers

Vice President, Holland & Knight Consulting, LLC. President and CEO, Corcentric, Inc. CEO, Global Software Corporation. President and CEO, Perfection Equipment.

Industry experience:

Advertising, PR & marketing; Aerospace & defense; Agriculture; Automotive; Beverages; Building & construction; Business services; Clean technology; Education and training; Electronics; Energy & renewables; Financial services; Food; Healthcare; Information technology; Insurance; Leisure; Life sciences; Luxury goods; Media, printing, and publishing; Plastics; Recycling; Retail and franchising; Security; Steel, metal, and woodworking; Telecom; Textile & clothing; Trade; Transport & logistics; Wholesale.

CEO

Rick Thomas

Vice President, VSI. Manufacturing Engineer, General Motors. M&A Executive Lecturer and Adjunct Faculty Member for NCCE and The George Washington University. US Representative to South African Companies.

Industry experience:

Automotive; Education and training; Engineering; Food; Information technology.

Principal

Michael Birmingham

Michael Birmingham, a Principal at FOCUS, joined the firm in 2021 and is a member of the Information Technology and Government, Aerospace, and Defense Groups. He is responsible for execution on sell-side and buy-side transactions, financial modeling and analysis, and assisting in business development.

Previously, Michael worked at Donovan Capital Group where he was responsible for originating and evaluating investments in middle-market aerospace, defense, and government technology companies. He started his career within Ernst and Young’s Government and Public Sector Consulting Practice working with defense and civilian clients on various performance improvement projects.

Michael is registered with the Financial Industry Regulatory Authority (FINRA) as an Investment Banking Representative and General Securities Representative (Series 79, 7 and 63). Based in the Washington metropolitan area, Michael holds an M.B.A. from Georgetown University’s McDonough School of Business and received his Bachelor of Arts from Dickinson College.

Industry experience:

Aerospace & defence; Information technology.

Managing Director

Barry Calogero

Barry Calogero, a FOCUS Managing Director, brings more than 30 years of executive management and consulting experience, with an emphasis on driving operational excellence and improving the enterprise value of companies around the world. His expertise includes Aerospace and Defense, Information Technology, Manufacturing, Healthcare, Life Sciences, Automotive, and Food Manufacturing & Distribution.

Industry experience:

Advertising, PR & marketing; Aerospace & defence; Business services; Education and training; Food; Government; Hotels & restaurants; Media, printing and publishing; Transport & logistics.

Senior Advisor

Marco Chan

Managing Principal & CEO, V2 Leadership Group Inc.

Managing Director, Global Supply Chain Logistics, FedEx. Managing Director & General Manager, China, FedEx. Managing Director, Business Logistics Services, Asia Pacific, FedEx. Managing Director, US Ground Operations, FedEx.

Managing Director

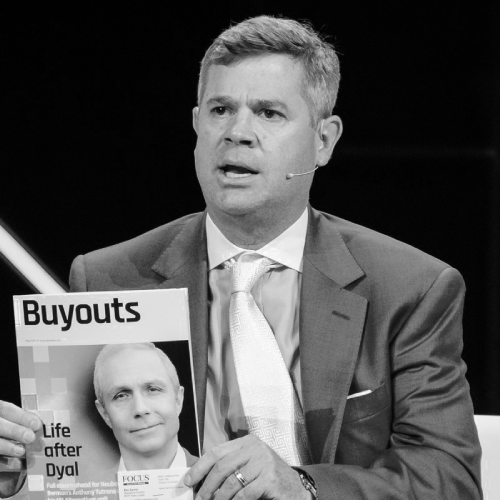

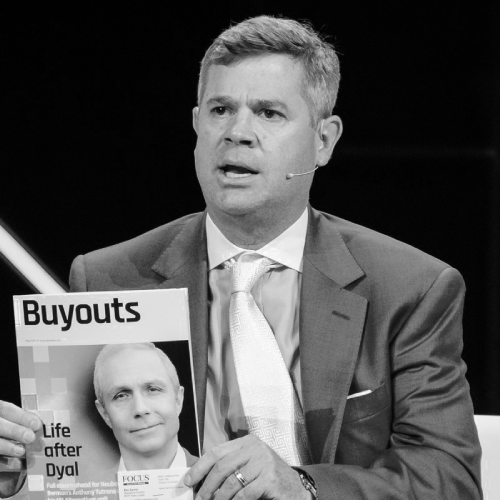

Abe Garver

Abe Garver, FOCUS’ MSP Team Leader, has over 25-years of professional experience in M&A investment banking and management consulting. Over the course of his career, he has worked on sell-side, buy-side and capital raise assignments with approximately 75 clients including public, private, Inc. 500 fastest growing and Top 50 MSPs companies.

Industry experience:

Information Technology.

Managing Director

Stan Gowisnock

Stan Gowisnock is a Managing Director in FOCUS Investment Banking’s Technology Services group. Over his 34-year career, Mr. Gowisnock has led multiple global acquisitions and successful integrations of market-leading companies in technology, manufacturing, and professional services.

Industry experience:

Automotive; Information technology; Transport & logistics.

Managing Director

James W. Hawkins

MBA. Ph.d. CEO, Metaphor Biopharmaceuticals, LLCPresident, and CEO of Synthecell Corporation in conjunction with serving as President and CEO of Genetic MediSyn Corporation. Co-founded and served as the Editor-in-Chief of the peer-reviewed scientific journal. Antisense Research and DevelopmentConsulted for companies rang.

Industry expertise:

Healthcare; Life sciences.

Managing Director

Eric Oganesoff

President and CEO, TracerNET, Inc.

CEO, GreenStone Industries, Inc.

President, Washington Resources Group, Inc.

White House appointment to NASA.

Industry expertise:

Aerospace & defence; Building & construction; Energy & renewables; Government; Information technology; Telecom.

Managing Director

Kelly Kittrell

Kelly L. Kittrell has more than 30 years of merger & acquisition and corporate finance experience. He advises business owners on sell-side and buy-side transactions, valuation analysis, corporate finance and equity and debt financings. He is based in Dallas.

Prior to joining FOCUS, Mr. Kittrell served as Ankura Consulting’s Head of Development and Acquisitions. His main responsibility at Ankura was completing acquisitions of companies in the professional services and consulting industry. He reviewed dozens of acquisition targets while at Ankura, preparing valuation analyses, negotiating financial and legal terms in letters of intent and closing documents, and performing due diligence. Ankura grew by acquiring six professional services firms during his tenure. Mr. Kittrell also served as Ankura’s CFO from inception through 2016.

Before his work at Ankura, he held the following high-profile M&A positions:

As Managing Director at Bank of America’s private company advisory services, he was a mergers and acquisitions advisor for clients in the strategy, analysis, and sale of client businesses. Mr. Kittrell developed and made presentations to clients and bank associates and generated sell-side mandates and valuation assignments, as well as led execution teams.

As a Director in Ernst & Young’s Corporate Finance practice, he provided strategic advice for clients in all aspects of M&A transactions, advising sellers in diverse industries including the sale of a large automobile retail chain and a newspaper publisher. He performed valuations on more than 50 going-concern companies, including a major commercial airline.

In addition to his M&A experience, Mr. Kittrell served as a Senior Litigation Consultant at Dallas law firm Bickel & Brewer, where he analyzed companies in litigation to determine valuations and damages, identified and worked with expert witnesses regarding financial testimony, and determined fallacies in opposing expert valuations, financial reports and damage claims. He also served as the Chief Investment Officer for a private investment family office and as the Chief Financial Officer for one of its portfolio companies, a publicly traded acquirer of direct selling businesses.

Industry experience:

Financial Services.

Managing Director

Jorge A. Maceyras

Investment Officer & Portfolio Manager, Loan Programs Office at the U.S. Department of Energy. Managing Consultant at IBM Global Business Services. FINRA-licensed securities research analyst and broker at FBR Capital Markets. Manufacturing Engineer at Human Genome Sciences, Inc.

Industry expertise:

Automotive; Engineering; Media, printing, and publishing; Telecom.

Managing Director

Bob Maiden

Bob Maiden, a FOCUS Managing Director, has extensive experience in public accounting, corporate finance and human capital management roles. Prior to joining FOCUS, Mr. Maiden was a partner at Stony Hill Advisors in the Philadelphia area where he founded and led the firm’s Human Capital Management M&A practice.

Mr. Maiden was co-founder and President of Maxwell Training Centers, a brick-and-mortar workforce training firm later transformed with a web-based SaaS model. Under his leadership, the Company earned four Wharton/Philadelphia Business Journal Top 100 Awards for being a Fastest Growing Privately Held Business. After 16 years of growth, Maxwell was acquired by inVentiv Health. Subsequent to the sale Mr. Maiden managed the integration, and led additional growth of the Company, staying with inVentiv for seven years. After his departure in early 2014 he launched his M&A advisory practice, focused on middle-market staffing, recruiting and HR technology companies.

Mr. Maiden has developed an extensive network of staffing firm owners/leaders from small private firms to the largest public firms across the U.S. and Canada, in every segment of the market. He is an active member of the American Staffing Association, New Jersey Staffing Alliance, Alliance of Merger and Acquisition Advisors and Association for Corporate Growth. Mr. Maiden has served as a judge and mentor on many entrepreneurial initiatives including Comcast Business Innovation-4-Entrepreneurs; Temple Fox School of Business Be Your Own Boss Bowl; The Young Entrepreneurs Academy (YEA!); Mercy Vocational High School; and has taught workshops at Drexel University’s Close School of Entrepreneurship on “Accounting for Startups.”

Mr. Maiden graduated from Drexel University with a B.S. in Accounting and a minor in Manpower Management.

Managing Director

Richard Pierce

Director in the Communications and Media Group of Stifel Nicolaus. Member of the Telecommunications Group at Legg Mason. Officer in the U.S. Army Military Intelligence Corps.

Industry experience:

Building & construction; Business services; Engineering; Information technology; Telecom.

Principal

Cyril Schlup

Expert in Finance and Working Capital Improvement. Led major organizational transformation and performance improvement projects for large multinational corporations—extensive corporate and consulting experience across Europe and the USA.

Industry experience:

Automotive; Business services; Healthcare; Media, printing, and publishing; Retail and franchising; Telecom.

Managing Director

John Slater

More than 200 successful M&A and CorpFin deals completed in excess of a billion (USD). Leads team often focused on Advanced Manufacturing & Automation. Metal Fabrication, Additive Manufacturing, Automation, Advanced Materials, Industry 4.0.

Industry experience:

Aerospace & defense; Business services; Engineering; Information technology; Media, printing, and publishing; Transport & logistics.

Co-leader of Advanced Manufacturing Industry Group.

Managing Director

April Taylor

April Taylor, a FOCUS Managing Director, has more than 20 years of consulting, management, and M&A advisory experience. Since joining FOCUS in 2010, Ms. Taylor has worked on numerous transactions involving businesses in the business services, human capital management, and technology and software fields.

Industry experience:

Business Services, Information Technology.

Principal

Leah White

Leah leads the e-commerce group at FOCUS Investment Bankings. A former research associate, she also participates in financial and valuation modeling for clients. Prior to joining the firm, Leah worked for many years at a large institutional investor, where she was responsible for research and analysis in its nearly $2 billion private equity and hedge fund investment strategies portfolio.

Industry expertise in eCommerce.

Member of the Consumer & Retail Industry Group.

Executive Director

Paul Waters

Paul Waters, FOCUS’s Chief Business Development Officer, has nearly 30 years of professional banking experience. In this new role at FOCUS, Mr. Waters will be responsible for managing referral programs, identifying and acquiring new referral programs, and identifying new investment banker candidates.

Prior to joining FOCUS, Mr. Waters worked the last 13 years elevating the M&A referral program (PSRN) at Bank of America Securities, Inc./Merrill Lynch. He was involved in all facets running the business, highlighted by his contributions to strategy, process and network investment bank management. Over his 27-year career at BofA, Mr. Waters held roles in investment banking, distribution, finance and project management. Prior to BofA Mr. Waters worked in public accounting.

Based in Yardley, PA, Mr. Waters holds a Bachelor of Science degree in Accounting from Rutgers University – Camden. He is a Certified Six Sigma Black Belt.

Managing Director

Paul Carter

Paul Carter, a FOCUS Managing Director, is an experienced M&A professional with over 10 years of investment banking experience advising middle market clients on various mergers and acquisitions, capital raising and capital market transactions. During that time, Mr. Carter’s primary emphasis has been on serving clients in the technology, software, and telecommunications industries.

Before joining FOCUS, Mr. Carter worked as a Vice President for Jefferies Group, LLC where he led multiple software-focused public market processes. He also led junior bankers in the production of materials for business development opportunities.

Mr. Carter also previously worked as a Vice President for Raymond James and Associates, leading multiple sell-side M&A processes across numerous technology industry sub-verticals.

Prior to that, Mr. Carter worked as an associate for Harris Williams and Co, and before that, Duff and Phelps where he advised on multiple engagements including sell-side M&A, capital raising, and transactions.

Mr. Carter served in the U.S Navy submarine fleet completing multiple deployments throughout the pacific theater and receiving numerous military awards, including Navy Achievement Medal and multiple Admiral citations. Based in Atlanta, GA, Mr. Carter holds a Bachelor of Arts Finance from Michigan State University, and he received his Master of Business Administration from the University of Oxford.

Industry experience:

Financial services; Information technology; Telecom.

Managing Director

Mike McCraw

Mike McCraw, Managing Director and Food & Beverage Team Leader at FOCUS, is an experienced entrepreneur and investment banker and has over 30 years’ experience serving clients with mergers & acquisitions, advisory services, and business consulting.

Prior to joining FOCUS, Mr. McCraw led the Consumer Team at Founders Investment Banking. While there, he helped launch a well-attended annual educational and networking event called the Multi-Unit Summit, bringing together top brand and industry leaders in a relaxed, high-quality environment. Mr. McCraw has also served as CFO for several multi-unit companies.

In addition, Mr. McCraw started and led the Outsourced Services Practice Group at Warren Averett, one of the largest CPA firms in the Southeast. Before Warren Averett, Mr. McCraw co-founded and served as managing principal of the Birmingham office of a regional CPA and consulting firm. He also started and helped lead a lower middle market private capital group focused on adding value alongside successful entrepreneurs. Mr. McCraw has served as CFO/COO of a regional construction sub-contractor, CFO of a manufacturing company and Controller at two leading hospitals.

Mr. McCraw is a Certified Public Accountant (CPA) and has a Master’s of Business Administration (MBA) from the University of Alabama at Birmingham. Mr. McCraw received his undergraduate degree in Accounting from Troy University, where he was quarterback on a National Championship team.

Industry experience:

Beverages; Business services; Education and training; Food.

Managing Director

John Sinders

John Sinders, a FOCUS Managing Director, has over 25 years of experience in the industrials and energy industry. He is a long-time global executive who has served in positions ranging from manager of energy departments for major investment and commercial banks to chief financial officer and board member for multi-billion-dollar global enterprises.

Prior to joining FOCUS, Mr. Sinders was the managing director at Founders Advisors, an investment banking firm, where he ran the energy and industrial services group. Before that he was an executive partner at Calera Capital, a middle-market private equity firm based in San Francisco and Boston.

Prior to that Mr. Sinders was executive vice president and chief administrative officer at Frank’s International, the second largest casing and well construction company in the world, where he was responsible for all non-operational matters as well as serving as an interim CFO. Before that he was joint head of the global energy practices at both Jefferies Group and RBC Capital Markets, and ran the investment banking department and served on the board of directors at Howard Weil, Labouisse, Friedrichs Inc. Earlier, he led the buyout of Aston Martin from Ford Motor Co. and was chairman of the board of Aston Martin of North America.

Mr. Sinders has also held a wide range of legal, director, business development, administrative, and general management roles. He is recognized for directing and securing billions of dollars worth of debt and equity financings and acquisitions around the world. He has a history of collaborating with boards and international business leaders to achieve shareholder objectives. Mr. Sinders possesses a passion for safety, process improvement, and integrity in all aspects of business. He has extensive experience in understanding financials and making sound decisions for his clients and has been acknowledged for a collaborative management style for coaching, mentoring, and developing future leaders of companies.

He earned his B.A. and J.D. at the University of Virginia, where he also earned Phi Beta Kappa honors as an undergraduate.

Industry experience:

Chemicals; Energy & renewables; Recycling.

Managing Director

William R. Snow

William R. (“Bill”) Snow, a FOCUS Managing Director, is an experienced M&A professional with over 30 years of professional experience, including almost two decades as an investment banker. His work includes business sales and capital raises for middle-market companies as well as buy-side services for acquirers seeking middle-market companies. Mr. Snow’s clients have included waterworks manufacturers and value-added distributors as well as firms focusing on packaging, medical supplies and equipment, automotive parts, drink dispensing equipment, security, apparel, refined fuels, and more.

Prior to joining FOCUS, Mr. Snow worked as a Managing Director for Jordan Knauff & Company, where he specialized in helping owners and executives raise capital for acquiring companies, divisions, business units, or product lines with revenues between $10 million and $300 million.

Mr. Snow has written articles for magazines and online periodicals as well as books about mergers and acquisitions (Mergers & Acquisitions For Dummies), early-stage capital (Venture Capital 101) and personal marketing (Networking Is A Curable Condition). He has presented at universities including Northwestern University, DePaul University, the Kent College of Law at the Illinois Institute of Technology, and Harvard Business School. He has also spoken before the Thomson Reuters Midwestern M&A/Private Equity Forum, J.P. Morgan Chase, Huntington Bank, Ice Miller, the Illinois CPA Society, and the University Club of Chicago.

A Vistage speaker, Mr. Snow has presented to groups in Chicago, New Orleans, Louisville, and Cincinnati. He has lectured internationally in Malaysia, Thailand, and the United Arab Emirates. He has an MBA and a B.S. in finance, both from DePaul University, and he’s a FINRA-registered Investment Banking Representative (series 62, 63, and 79).

Industry experience:

Advertising, PR & marketing; Business services; Steel, metal and wood working; Textile & clothing; Wholesale.

Managing Director

Jim Sowers

Jim Sowers, a FOCUS Managing Director located in Richmond, Virginia, has over 30 years of experience in investment banking and corporate finance. He specializes in the Food & Beverage, Government & Defense, and Business Services industries.

Prior to joining FOCUS, Mr. Sowers was a managing director with Transact Capital Partners, a boutique M&A firm, where he successfully represented dozens of business owners selling their companies in a variety of industries, including government services, consumer products, business services, staffing, and industrial manufacturing. Before that he was a vice president at BB&T Capital Markets, where he worked on numerous IPOs, sell side transactions, fairness opinions, and capital raises, mainly for consumer products companies and restaurants.

Mr. Sowers began his career as an engineer in the defense industry. After receiving his MBA, he worked in the treasury departments of IBM and PepsiCo on corporate acquisitions and debt financing. After moving to operating companies, he worked in both financial planning and analysis, corporate development, and as a regional CFO. Mr. Sowers found his corporate development roles at PepsiCo particularly valuable, as each division had a strategic acquisition plan coupled with a disciplined valuation process. Mr. Sowers also previously worked in corporate finance and corporate development at General Electric and LandAmerica.

Mr. Sowers received a B.S. in systems engineering from the University of Virginia and his MBA from the Darden School of Business at UVA. He is a long-standing member of the Henrico County Grand Jury, treasurer of his church, a member of the Association for Corporate Growth, and the advisory council of Virginia State University’s Reginald F. Lewis College of Business.

Mr. Sowers holds FINRA 7, 24, 28, 63 & 79 licenses.

Industry experience:

Aerospace & defence; Beverages; Business services; Food; Government.

Principal

Chandler Kohn

Chandler Kohn, a FOCUS Principal, boasts nearly a decade of experience in management consulting and investment banking projects spanning the automotive aftermarket and autotech sectors, as well as the energy sector.

Before joining FOCUS in 2023, Mr. Kohn served as vice president of investment banking at Capstone Financial Group, an investment bank specializing in the automotive aftermarket and autotech. Mr. Kohn’s clients included automotive wholesale distributors, e-commerce dealers, and various parts suppliers. He has also supported late-stage LiDAR (light detection and radar) startups racing to secure a position as an L3+ autonomous driving supplier, companies pioneering DC fast charging infrastructure robots, software-driven teams developing advanced touch technology capabilities for the “cockpit of the future,” and those applying advanced artificial intelligence and machine learning to detect impairment in fleet drivers.

Mr. Kohn’s consulting background was primarily directed to gas and power trading shops seeking to improve their financial and physical energy trading and risk management capabilities.

Mr. Kohn holds a Bachelor of Science degree in Business Administration from the College of Charleston and a Master of Science degree in Finance from Tulane University.

Industry experience:

Automotive; Steel, metal and wood working.

Principal

Cole Strandberg

Cole Strandberg, a FOCUS Principal, joins the FOCUS team following nearly a decade of banking and operational experience in the automotive, transportation, and distribution industries.

Prior to joining FOCUS in 2022, Mr. Strandberg was director of business development for Autotality (formerly Filterworks USA), the leading provider of facility design, equipment, and service solutions for the automotive repair industry. During his time with Autotality, the company partnered with a private equity firm and subsequently made six add-on acquisitions, eventually quadrupling in size. Mr. Strandberg was responsible for the company’s growth efforts, including key account management, strategic sales & marketing, and various operational management functions.

Before Autotality, Mr. Strandberg was an associate on the equity capital markets team at Noble Capital Markets, a boutique investment bank focused on small cap emerging growth companies in the health care, technology, media, transportation & logistics, and natural resources sectors.

Mr. Strandberg’s deep automotive industry knowledge and network, combined with his significant transaction experience on both the sell side and the buy side, makes him a valuable asset to FOCUS’s Automotive Aftermarket Team.

Mr. Strandberg earned a Master of Science degree in entrepreneurship from the University of Florida Warrington College of Business and a Bachelor’s degree in business administration and finance from the University of Mississippi.

Industry experience:

Automotive.

Senior Advisor

Anders Moeller

Anders Moeller joins FOCUS as a Senior Advisor after more than 25 years in various C-Level Business positions at both publicly traded and privately held organizations. His global experience includes the food/beverage, luxury goods, software, e-commerce and automotive industries.

He earned a Business and Marketing degree from Denmark’s Business College South and leadership certifications from Wharton & Goizueta Business School at Emory University. His background includes critical roles transforming business operations and increasing shareholder value through organic and M&A initiatives, for entities including Anheuser-Busch, The Coca-Cola Company, Gibson Brands, Solera Inc. (now Vista Equity), Cardone Industries and OWS Automotive Group. He has also been a part of several industry-government partnerships, and has worked closely with key players in the supply-chain and advanced manufacturing arenas.

Anders’ experience has enabled him to develop an intimate understanding of business operations, and M&A processes, across nine countries on three continents. With an approach that emphasizes value-based management, strategic business planning and exceptional communication among all involved parties, he looks forward to serving the clients of FOCUS and helping them realize their personal and professional dreams.

Industry experience:

CAerospace & defence; Government; Steel, metal and wood working; Transport & logistics.

Senior Advisor

Bob Bicksler

Bob Bicksler was employed at JML Optical Industries, LLC, a manufacturer of precision optics and optical assemblies, from 2011 through its recent sale to Thorlabs in January 2023. He held the title of President & CEO. During his time at JML, Mr. Bicksler also held the position of Professor of the Practice, at Kenan-Flagler Business School at the University of North Carolina-Chapel Hill. Mr. Bicksler held this role for 7 years (March 2013 – January 2020). Before this, prior to the sale of its business to Neusoft (SH:600718), Mr. Bicksler served as the President and CEO of TapRoot Systems, a leading provider of software products and services for the mobile device market. Mr. Bicksler has over 30 years of operational and financial background in manufacturing, technology, and telecommunications companies. His track record is one of continued success in growing companies and leading them to a successful exit resulting in superior returns to investor groups. Mr. Bicksler began his career at PriceWaterhouseCoopers LLP and was a managing partner when he left to pursue his entrepreneurial career. Since PriceWaterhouseCoopers, Mr. Bicksler has led and developed many companies as CEO, Executive Vice President, and/or Chief Financial and Administrative Officer including AT&T Canada (sold to AT&T Corp. in $8B transaction), howstuffworks.com International (merged into NASDAQ company), Global Metro Networks, MetroNet (IPO), Performance Awareness Corp. (sold to IBM/Rational Software), Seer Technologies, Inc. (IPO), and Megapath Communications. Mr. Bicksler’s experience providing strategic merger and acquisition consulting services also comes from his former role as a Principal of Catalina Consulting during which he was responsible for evaluating numerous companies on behalf of private investment firms. Mr. Bicksler is an active member and advisor to several Boards.

Mr. Bicksler holds degrees from The Pennsylvania State University (BS, Business Administration) and The University of North Texas (MS). He is also a Certified Public Accountant.