Urgent Task Force

Want to know more?

Download here the latest Industry Reports, opinions, and whitepapers.

The 2020 Urgent Task Force Brochure is available.

Get in touch

Get ready.

One week is all it takes.

to find that solution, and all it takes is a week. The URGENT TASK FORCE is here to support you and maximise your options while you still have some.

Our market view

Many companies have been severely impacted by the COVID-19 pandemic. This has resulted in as much as 30% decreased revenues, sometimes even more. Regrettably, these companies have been

put under a lot of pressure and may not survive if current restrictions and lockdowns remain in place. Ultimately, they may require urgent action to be sold, re-financed or re-structured. There is, quite literally, no time to lose.

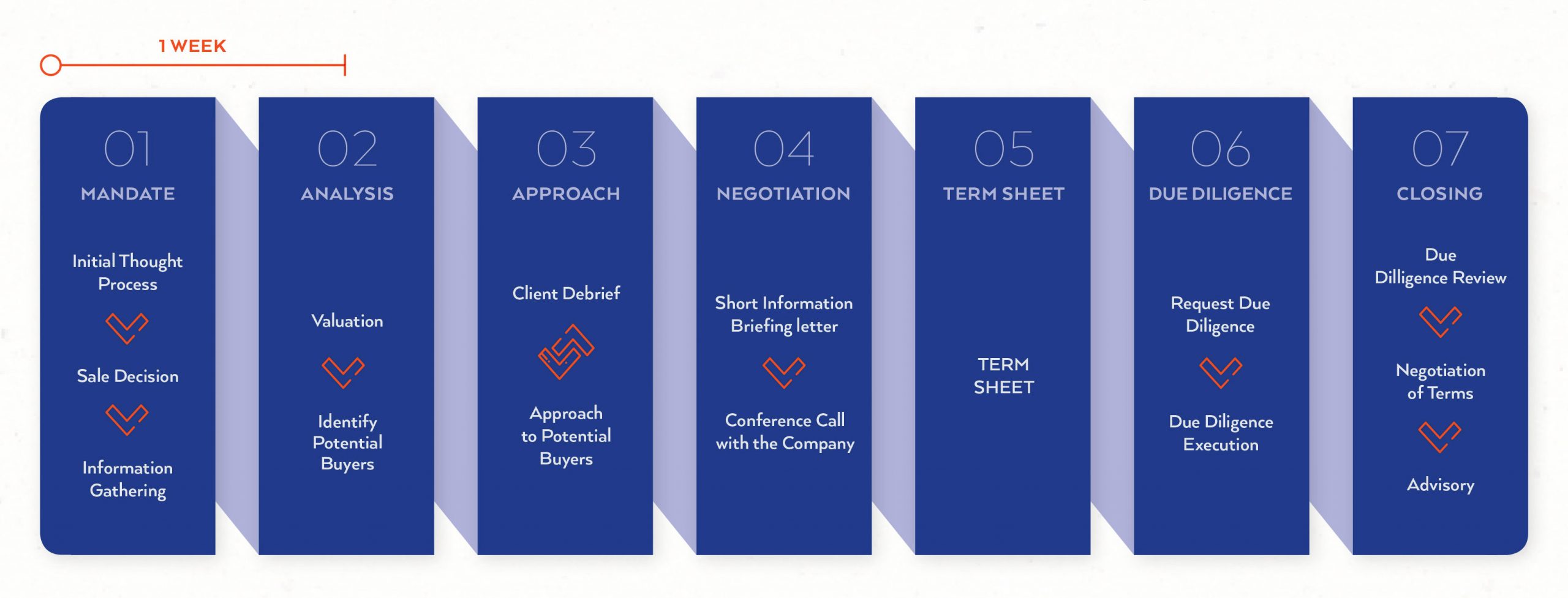

From Strategy to Closing

Our professionals will lead the complete process. With expertise in every area

and global Industry Groups, you will have the necessary specialised help, that you company needs. See the steps on this page to get a better understanding of what this service has to offer. We focus on speed and outcome. If you choose to work with us, you will be moving quickly, as one week is all it takes to get you ready.

PROCESS STEPS

The certainty of a sucessfull transaction

In the current, uncertain, environment it is even more important to position your company with the highest value-added proposition. In order to achieve that, you’ll need to work with experts which offer the best scope, experience and expertise.