Overcoming Challenges in Valuing a Company for M&A

Valuing a company for mergers and acquisitions (M&A) is a complex endeavour, with various obstacles that can lead to inaccurate assessments and potentially costly mistakes. To ensure a successful transaction, it’s crucial to address these challenges effectively. Let’s break down some key strategies to overcome the major valuation challenges:

- Simplify Complex Financial Structures

Companies often have intricate financial structures, including multiple subsidiaries or joint ventures, which complicate valuation. To overcome this, focus on simplifying the financial picture by consolidating key financial metrics and understanding how different parts of the business contribute to overall value. Detailed financial audits and external expertise can help untangle these complexities, providing a clearer view of the company’s true worth.

- Standardize Financial Reporting

Inconsistent financial reporting between companies can obscure key insights. The solution is to adopt uniform accounting standards, such as adjusting all financials to a consistent framework like IFRS or GAAP. This ensures comparability and eliminates potential biases in valuation caused by differences in reporting practices.

- Value Intangible Assets Carefully

Intangible assets such as intellectual property, brand reputation, and customer relationships are often tricky to quantify. The key to overcoming this challenge is to utilize market comparables and income-based approaches, such as estimating the future cash flow these assets are likely to generate. Hiring third-party appraisers who specialize in intangibles can also provide an objective and accurate assessment.

- Account for Market Volatility

Market conditions can fluctuate, making it difficult to pin down a reliable valuation. One way to overcome this challenge is by using scenario analysis, which involves running different models based on various market conditions (bullish, bearish, or neutral). Additionally, focusing on long-term value drivers rather than short-term market fluctuations will provide a more stable valuation framework.

- Estimate Synergies with Caution

Synergy estimations—whether in cost savings or revenue enhancements—are often overestimated in M&A deals. To avoid this pitfall, adopt a conservative approach when estimating synergies. Ensure that assumptions about cost reductions or increased revenue streams are grounded in reality, and verify these projections with external benchmarks or past case studies.

- Enhance Due Diligence

Rushed or incomplete due diligence is a common reason for post-merger surprises. Conducting comprehensive due diligence is essential. This includes deep dives into financial, operational, and legal aspects, ensuring that nothing is left unexamined. Leveraging data analytics tools to process large volumes of information can also help streamline this process.

- Mitigate Regulatory Risks

Regulatory and legal issues can derail deals if not properly accounted for. To overcome this challenge, involve legal experts early in the process to assess potential compliance risks, antitrust concerns, and other legal liabilities that could affect the deal’s success.

- Bridge Cultural Differences

Cultural integration is often underestimated in M&A transactions. To address this, invest time in cultural assessments and plan for post-merger integration with a focus on aligning leadership styles, employee engagement, and corporate values.

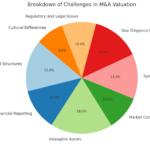

Below the page is a pie chart representing the relative importance of each challenge in valuing a company for M&A. Click on the image for better resolution.

These are also important points to consider:

Industry Complexity

Challenge: Valuing businesses in complex or niche industries can be challenging due to unique factors. Finding comparable companies for benchmarking can be difficult for unique or niche businesses.

Solution: Engage experts who have access to industry research and can understand the specific challenges and dynamics of the business. Should be considered how the industry impacts the company and discuss how that will be reflected in the valuation. Consider a wide range of industries that may share characteristics with the company.

Future Projections

Challenge: Predicting future cash flows and growth rates is inherently uncertain.

Solution: Base projections on realistic assumptions, consider a range of scenarios and perform sensitivity analysis. Compare the company to its peers to determine if the margins and balance sheet composition appear reasonable. E.g. use discounted cash flow (DCF) methods with supportable assumptions.

Communication and Transparency

Challenge: Communicating the valuation process and results to stakeholders can be challenging.

Solution: Work with a professional M&A advisor to clearly communicate the methodology, assumptions, and limitations of the valuation. Provide transparency to build trust, address any concerns from stakeholders, and eliminate bias in the information provided to the advisor.

Changing Business Environment

Challenge: Rapid technological changes, market dynamics, or regulations can impact the business value.

Solution: Update the valuation regularly based on changes in the business environment. Stay vigilant about external factors that may influence the business’s prospects.