Facts Trends and Tendencies to look out for in the Advanced Manufacturing sector

In 2025, the mid-cap M&A landscape in the advanced manufacturing sector is influenced by several key trends:

1. Resurgence of Mid-Market Deals: Stabilizing interest rates and improved access to capital have bolstered confidence among dealmakers, leading to a significant uptick in mid-cap M&A activity. Companies are focusing on core revenue-generating functions and divesting non-core assets to enhance competitiveness. This strategic realignment is particularly evident in sectors undergoing digital transformation, where acquiring niche technology providers is essential for staying ahead.

2. Private Equity’s Expanding Role: Private equity firms are increasingly targeting mid-cap manufacturing companies, drawn by the potential for innovation and growth. With substantial capital reserves, these firms are investing in high-potential assets, especially in technology-driven manufacturing sectors. For instance, Sky Island Capital raised $300 million to acquire U.S. manufacturing companies, reflecting a broader trend of private equity interest in this space.

3. Focus on Supply Chain Resilience: The COVID-19 pandemic underscored vulnerabilities in global supply chains, prompting mid-cap manufacturers to seek greater control over their production processes. This has led to increased M&A activity aimed at vertical integration, with companies acquiring suppliers and distributors to enhance supply chain resilience and reduce dependency on external entities.

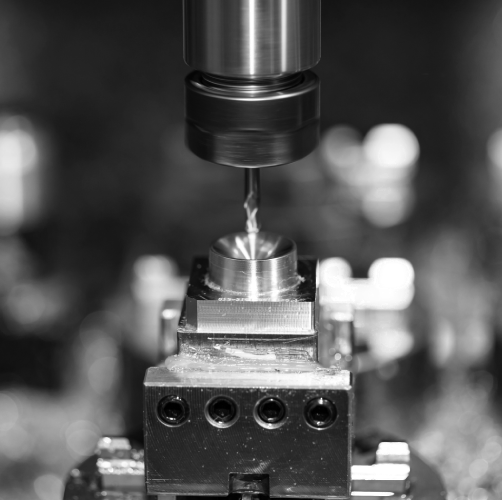

4. Adoption of Advanced Technologies: The integration of artificial intelligence (AI) and automation is transforming manufacturing processes. Mid-cap companies are engaging in M&A to acquire technological capabilities that enhance efficiency and competitiveness. This trend is driven by the need to modernize operations and meet the evolving demands of the market.

5. Geopolitical Influences on M&A Activity: Geopolitical factors, such as trade policies and regional conflicts, are impacting M&A strategies. Companies are reassessing their geographic footprints and pursuing acquisitions that mitigate risks associated with geopolitical uncertainties. This includes diversifying operations across multiple regions to safeguard against potential disruptions.

These trends highlight a dynamic and evolving mid-cap M&A environment in the advanced manufacturing sector, driven by strategic investments, technological advancements, and a focus on operational resilience.